Knowledge Sharing

CONSTRUCTION SUPPLY CHAIN RISKS AND TIPS

The construction industry is ripe with conflicting information about supply chain interruptions and delays. Some sources indicate that the supply chain outlook is positive and nearly back on track, while others predict significant delays for the remainder of the year. Our construction teams continue to monitor manufacturers and suppliers to understand the true impact on construction schedules. The truth is, supply chains are simply changing. There is unpredictability created by a number of factors. The biggest is actually not manufacturing or production, but shipping and freight.

THE BIGGEST PINCH POINT: SHIPPING

The entire shipping system is impacted by the surge in activity since the onset of COVID. From Amazon to Shutterfly and everything in between, shipping delays are happening in every industry and construction is no exception. The main reason for this interruption, as it relates to construction materials, is the reduction in air freight. Historically, up to 50% of traditional air freight comes from cargo space within passenger airline holds. The number of commercial flights has reduced significantly, therefore creating less capacity and slowing delivery times.

As a result, manufacturers are reluctant to offer “quick ship” options (fee-based services) in order to hit tight procurement timelines. Manufacturers’ quick ships were critical for buying lighting and mechanical equipment within the fast-paced tenant improvement market and it is unclear when their prevalence will return.

KEY TO NAVIGATING SUPPLY CHAIN ISSUES: A REALISTIC SCHEDULE

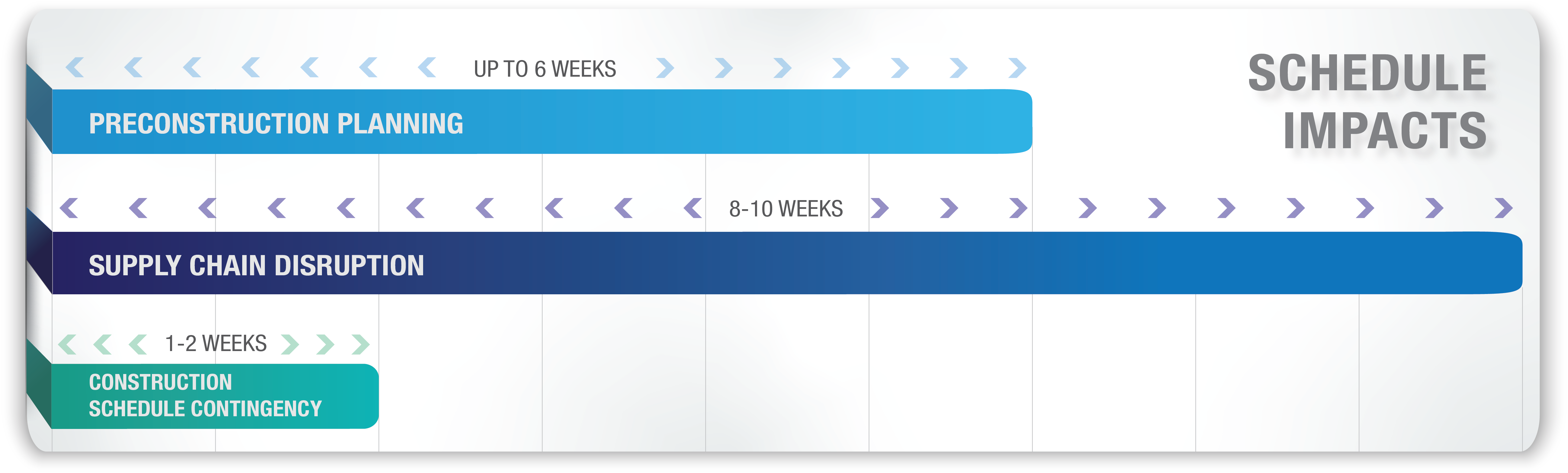

Extra time in both preconstruction and construction is necessary right now, in order to efficiently procure materials, sequence trades and meet project schedules. General contractors need to be mindful of this and add up to an additional 6 weeks of preconstruction to the schedule to allow for a more robustly planned procurement process. Every item being sourced for the project, from high end finishes, mechanical equipment and lighting, down to fasteners, bolts and screws, must be mapped out in detail to understand the source of origin, manufacturing lead times and shipping timeframes.

Currently supply chain and manufacturing disruptions are causing maximum variances of 8-10 weeks vs. pre-pandemic timelines. Meaning, a custom light fixture with an original lead time of 8 weeks is now likely to arrive in 16 weeks. Other similar products may be completely unaffected. By allowing additional time in preconstruction, construction teams can account for the expected shipping delays and sequence the schedule accordingly.

On-site construction schedules will benefit from an additional 1-2 weeks of schedule contingency. It’s important to plan for unpredictable delays that will surface throughout construction.

SPECIFIC PRODUCTS & REGIONAL DELAYS TO WATCH

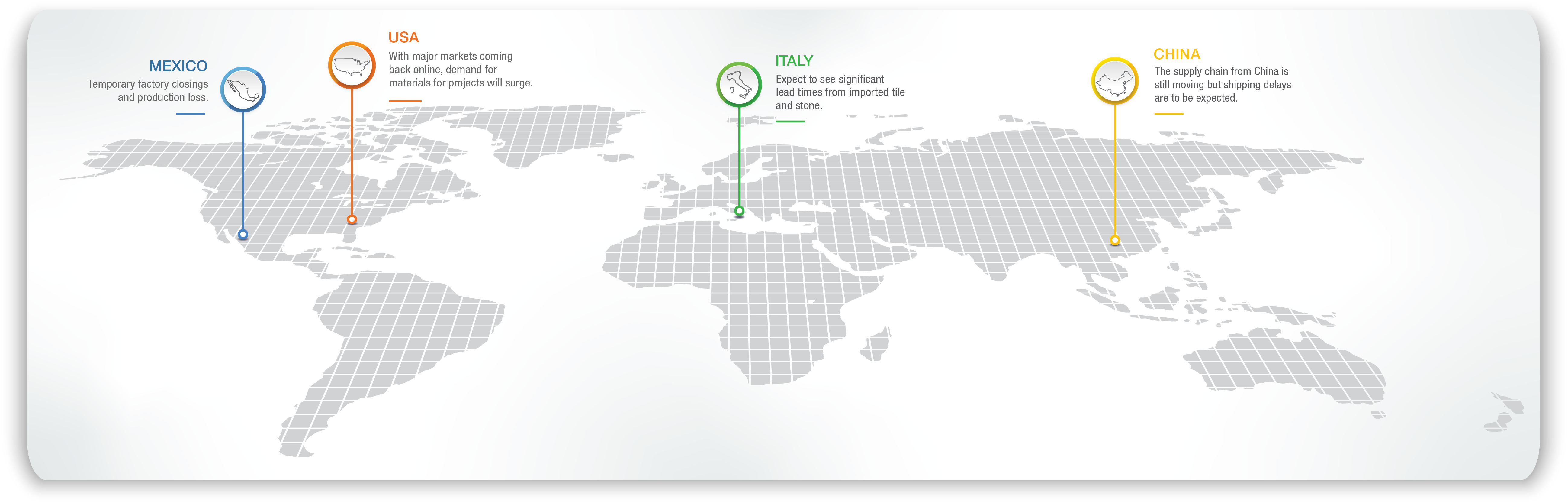

While supply chain and shipping information differs from product to product and week to week, here is a consolidated list of some of the major lead times and hot bed areas to monitor closely.

- Electrical supplies and lighting: There is looming potential for a shortage of 1900 junction boxes that go behind every electrical device. Additionally, electrical panels, which took less than a week to get prior to COVID-19, are now pushing 6-8 weeks. Custom fabricated light fixtures are experiencing double the normal lead times from 8-12 weeks up to 16-20 weeks.

- Architectural Products out of Italy: With the large infection rate in Italy plus shipping delays and a backup of orders, expect to see significant lead times from imported tile and stone from Italy and other parts of Europe.

- Items Made or Assembled in Mexico: Mexico is home to many manufacturers in the automotive and electromotive industries. HVAC vendors like Trane and Carrier assemble many of their products there. In recent weeks they have seen a spike in infections, resulting in temporary factory closings and production loss. Quick ships, as mentioned above, are no longer available as a standard option.

- Items Made or Assembled in China: By and large the supply chain from China is still moving but shipping delays are to be expected.

- Construction influx from USA: Construction restrictions have been lifted in many major metropolitan cities within the US including the Bay Area, New York and Boston. With these major markets coming back online, demand for materials to re-boot projects will surge, putting significant strain on manufacturing output and shipping capacity.

The most impactful thing a general contractor can do to plan a construction project is over-communicate with vendors and suppliers; create a procurement log and track changes daily and keep owners abreast of all changes and stay nimble. Everyone is juggling the inconsistencies in supply chain and shipping delays as the industry navigates through this unpredictable time.

READ NEXT